Years in the Making

In 2014 SEDCO Capital became the first Saudi and Shariah-compliant asset manager to sign the United Nations’ Principles of Responsible Investing (UNPRI).

This emphasis has been central to SEDCO Capital for many years. Since the firm’s inception, we have developed a reputation as a highly capable asset manager with Shariah compliance and ethical investing at our core.

A new investment philosophy was developed by SEDCO Capital in 2013 that combined the strengths of traditional responsible investing with Shariah investment principles. This unique set of principles is termed Prudent Ethical Investment (PEI).

The Covid-19 pandemic affected the global economy in 2020 causing a reassessment of institutional and individual values. With its established PEI philosophy, SEDCO Capital is perfectly placed to guide investors seeking greater emphasis on sustainability, transparency and ethical investment.

Our PEI Approach

Our Prudent Ethical Investment (PEI) approach is a disciplined and rigorous process involving five key fundamentals:

- Negative screening

- Environmental factors

- Social factors

- Governance factors

- Active ownership

Negative Screening

We employ an exclusionary screening process of sectors that are deemed unethical (including alcohol, tobacco, gambling and other non-permissible sectors). This initial step of negative screening reflects the commonalities between Shariah-compliant and conventional responsible investment strategies.

Balance Sheet Screens

In addition to negative screening, and in line with Shariah-compliance, we also evaluate the quality of the balance sheet.

Specifically, Shariah-compliance requires balance sheet screens that consider factors such as leverage, cash and the value of interest-bearing securities and/or accounts receivable to market cap or to total assets (whichever is greater). This allows us to avoid high financial risks and therefore enhance risk-adjusted returns.

Lower financial leverage and better cash conversion result in a bias towards quality and growth, underscoring the ‘prudence’ element in our PEI approach.

Environmental, Social and Governance (ESG) Criteria

SEDCO Capital and its external managers then apply an overlay of best practice environmental, social and governance criteria to the overall assessment.

Using data gathered from our internal and external research, we carry out scenario analysis and modelling to assess factors representing the investment impacts of future environmental trends and climate-related risks and opportunities.

We analyze the potential impact of each factor on a company’s competitive advantage (for example, revenue generation, cost savings and innovation), risk reduction (cost of financing, reduced volatility) and reputation building (governance, regulatory compliance, and client and workforce loyalty).

We consider ESG issues in strategic asset allocation in terms of asset classes, geographic markets, and sector weightings.

In terms of managing potential conflicts, our Conflict of Interest Policy covers all aspects of the investment process, governance, guidelines on handling of conflicts of interests, escalation and reporting.

How PEI relates to each of our asset classes

Income Assets

SEDCO Capital applies a set of screens and exclusions that are in line with its Shariahcompliant investment philosophy.

The firm analyzes sukuk, murabaha and other income assets from an ESG perspective, as part of the issuer review for financial/qualitative risks and other considerations. The ESG assessment is an integral part of issuers’ investment analysis and other specific instruments.

Public Equity

ESG is analyzed at a stock level, followed by discussions around any negative outcomes in order to determine potential engagement.

We exclude all companies engaged in: the manufacture and distribution of products/ activities forbidden by Islamic law (alcohol, tobacco, pornography, and others); restaurant and hotel businesses (except those not selling alcohol); operators of casinos and manufacturers of gambling machines; and the manufacture of military equipment.

Our negative screening criteria typically do not change. Stocks are regularly reviewed to check if they still pass the negative screening criteria. Management assessments and Boardrelated developments are monitored daily to identify any weaknesses that may cause the investee company strategic dislocation.

Private Equity

The firm’s focus is to engage with private equity general partners to promote the incorporation of ESG into investment decisions. This approach forms part of an ongoing dialogue with the general partners and, where applicable, through participation in advisory committees. The firm may agree to certain ESG considerations and exclusions through side letters with the general partners.

For co- and direct-investments, the firm aims to use an active ownership approach to promote ESG-related elements with the general partners leading the transaction. In particular, the firm aims to engage with portfolio companies to directly or indirectly promote ESG compliance and reporting. However, the firm’s ability to require any ESG due diligence or reporting may be limited by its status as a minority co-investor.

Real Assets

Responsible investment criteria are integrated in all phases of the investment process – from sourcing to selection, management, monitoring, and ownership activities.

ESG and building energy rating constitute a major part of our sourcing and selection criteria and help filter opportunities during the sourcing phase. When it comes to our valueadd strategy, we target properties where we can enhance value to the assets or reposition them to be more environmentally efficient.

We assess ESG issues during the initial due diligence phase of potential property acquisitions, and we evaluate risks and benefits in the due diligence documentation.

The firm scores new investment opportunities based on ESG criteria, while regularly evaluating and updating ESG considerations on existing properties. Because Islamic finance and responsible investment are already closely aligned, we follow a Shariah-compliant investment approach.

Signatory of the UN Principles for Responsible Investment (UNPRI)

SEDCO Capital was the first Saudi and Shariah-compliant signatory of the United Nations Principles for Responsible Investment (UNPRI), the principle-based framework designed to incorporate ESG characteristics in the context of analyzing investment risk.

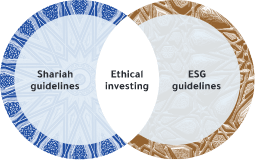

Islamic finance and responsible investing are both ethical in nature. Both principles align in their aim to improve the living conditions and well-being of society, to establish social equality and to prevent injustice in trade relations. Accordingly, SEDCO Capital sees much synergy between the two principles.

For SEDCO Capital, responsible investing and environmental, social and (corporate) governance aspects are an integral part of its activities. SEDCO Capital aims to be a prudent investor, who avoids undue risks and seeks sustainable investments with strong governance that are in compliance with relevant regulation. SEDCO Capital believes that an ESG overlay can lead to long-term rewards in terms of risk reduction and potentially higher returns. SEDCO Capital aims to use the ESG assessment to incorporate non-financial information and to identify risk factors.

SEDCO Capital invests in asset classes including Listed Equities, Private Equity, Real Estate, and Income. Part of these assets will be managed directly or managed by external investment managers. SEDCO Capital applies responsible investment criteria for selecting these managers as well.

ESG Integration

As a signatory of the UNPRI, SEDCO Capital aims to incorporate ESG considerations into its investment process subject to its overriding duties to its clients.

SEDCO Capital regards ESG integration as an investment decision making process that considers the environmental, social and corporate governance risks associated with the companies in which it invests and employs strategies to evaluate their impact within the context of financial analysis. This process is a sound complement to the traditional investment analysis focused on financial data. Furthermore, SEDCO Capital intends for its investments to contribute to sustainable development – meeting the needs of the present without compromising the ability of future generations to meet their own needs.

The firm’s ESG approach is an integral part of the investment process in all asset classes and strategies. ESG analysis complements traditional financial analysis and investment due diligence. The result of the ESG assessment is part of the overall assessment of an investment opportunity and is subject to the overriding duty of SEDCO Capital to protect the interests of its clients.

Integration in Asset Classes

SEDCO Capital incorporates responsible investment approaches in all its investment activities. There are no exceptions in SC’s responsible investment approach relative to its overall investment policy.

Islamic finance and responsible investment are well aligned. SEDCO Capital considers Shariah-compliant investing as a sub-set of responsible investing. Therefore, SEDCO Capital applies the same investment guidelines and aims to restrict non-permissible activities which include the following:

- The manufacture and/or sale/distribution of alcohol, tobacco and pornographic productions.

- Restaurant or hotel/motel businesses, except those not selling alcohol.

- Operators of gambling casinos or manufacturers of gambling machines.

- The manufacture of military defense equipment or weaponry.

Manager Selection

The manager selection criteria apply for liquid assets, private equity and real estate.

SEDCO Capital includes ESG assessment both in the initial due diligence as well as the ongoing monitoring of its external investment managers. External investment managers are expected to:

- Provide details of the manager’s ESG policies.

- Disclose to SEDCO Capital how they integrate ESG into their investment decisions and the

- competence and drivers for their staff to incorporate ESG considerations.

- Disclose to SEDCO Capital the manager’s ESG activities, including research, voting and engagement.

SEDCO Capital expects that fund managers will document and be able to provide meaningful data in relation to the number of engagements, proportion that relate to ESG issues and number of successful engagements with companies.

SEDCO Capital may assess the following aspects:

- If the manager has a structured approach to managing ESG risks and opportunities.

- Transparency: access to ESG information, scope of information, quality of ESG information.

- Ability to mitigate ESG risks: risk exposure assessment, adhesion to the principles of the UN Global Compact, ESG policies and implementation, ESG characteristics, presence of quantified and dated targets, ESG performance, and trend.

- The news flow: controversial news, reputational risk.

SEDCO Capital aims to analyze the investment process of external managers from an ESG perspective in the initial due diligence. SEDCO Capital promotes responsible investment to existing managers that do not yet adhere to responsible investment principles. SEDCO Capital annually reviews the manager’s responsible investment process.

This analysis is documented in the investment research and due diligence memos. Investment decisions should consider this documentation. Regular updates on ESG should be documented in Manager Discussion Summaries.